Inflation in India: Causes, Impact, and RBI’s Monetary Policy Response

Introduction

Inflation is one of the most critical macroeconomic challenges faced by developing economies like India. It directly affects household purchasing power, savings, investment decisions, poverty levels, and overall economic stability. For policymakers, managing inflation without hampering growth is a delicate balancing act. In India, inflation management lies primarily with the Reserve Bank of India (RBI), operating through its monetary policy framework. For UPSC aspirants, inflation is a high-priority topic for GS Paper III, essay writing, and prelims conceptual clarity.

What is Inflation?

Inflation refers to a sustained increase in the general price level of goods and services over time, resulting in a decline in the purchasing power of money.

Key inflation indicators in India

- Consumer Price Index (CPI) – Primary inflation indicator used by RBI

- Wholesale Price Index (WPI) – Measures price changes at wholesale level

- Core Inflation – CPI excluding food and fuel

RBI targets inflation based on CPI.

Measurement of Inflation in India

Consumer Price Index (CPI)

- Compiled by the National Statistical Office (NSO)

- Reflects price changes faced by households

- Used for inflation targeting under the RBI Act

Wholesale Price Index (WPI)

- Measures price movements at the producer level

- Useful for understanding supply-side pressures

Types of Inflation

Demand-Pull Inflation

Occurs when aggregate demand exceeds aggregate supply.

- High consumer spending

- Expansionary fiscal policy

- Easy credit availability

Cost-Push Inflation

Occurs due to rising production costs.

- Increase in fuel prices

- Wage hikes

- Supply chain disruptions

Built-in Inflation

- Wage-price spiral

- Inflationary expectations

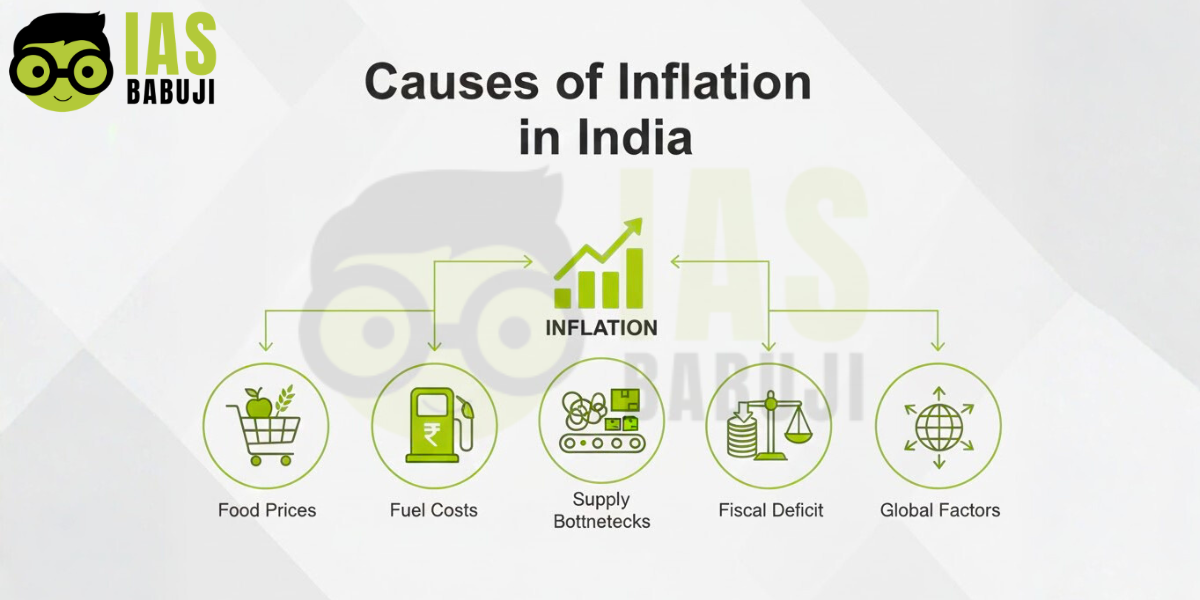

Major Causes of Inflation in India

Food Inflation

- Dependence on the monsoon

- Supply bottlenecks in agriculture

- Storage and distribution inefficiencies

Fuel and Energy Prices

- Global crude oil price volatility

- Exchange rate depreciation

- High import dependence

Supply-Side Constraints

- Infrastructure gaps

- Logistics inefficiencies

- Climate-induced disruptions

Fiscal Factors

- High government expenditure

- Revenue deficits

- Subsidy pressures

Global Factors

- Imported inflation

- Geopolitical tensions

- Global commodity price shocks

Impact of Inflation on the Indian Economy

Impact on Households

- Erosion of purchasing power

- Higher cost of living

- Adverse impact on poor and fixed-income groups

Impact on Savings and Investment

- Discourages financial savings

- Increases uncertainty for investors

Impact on Growth

- Moderate inflation may support growth

- High inflation distorts economic decision-making

Impact on the External Sector

- Weakens export competitiveness

- Pressures the current account balance

Inflation Targeting Framework in India

India adopted Flexible Inflation Targeting (FIT) in 2016.

Key features

- CPI inflation target: 4 percent

- Tolerance band: 2 percent to 6 percent

- The Monetary Policy Committee (MPC) decides policy rates

Composition of MPC

- RBI Governor (Chairperson)

- RBI officials and government nominees

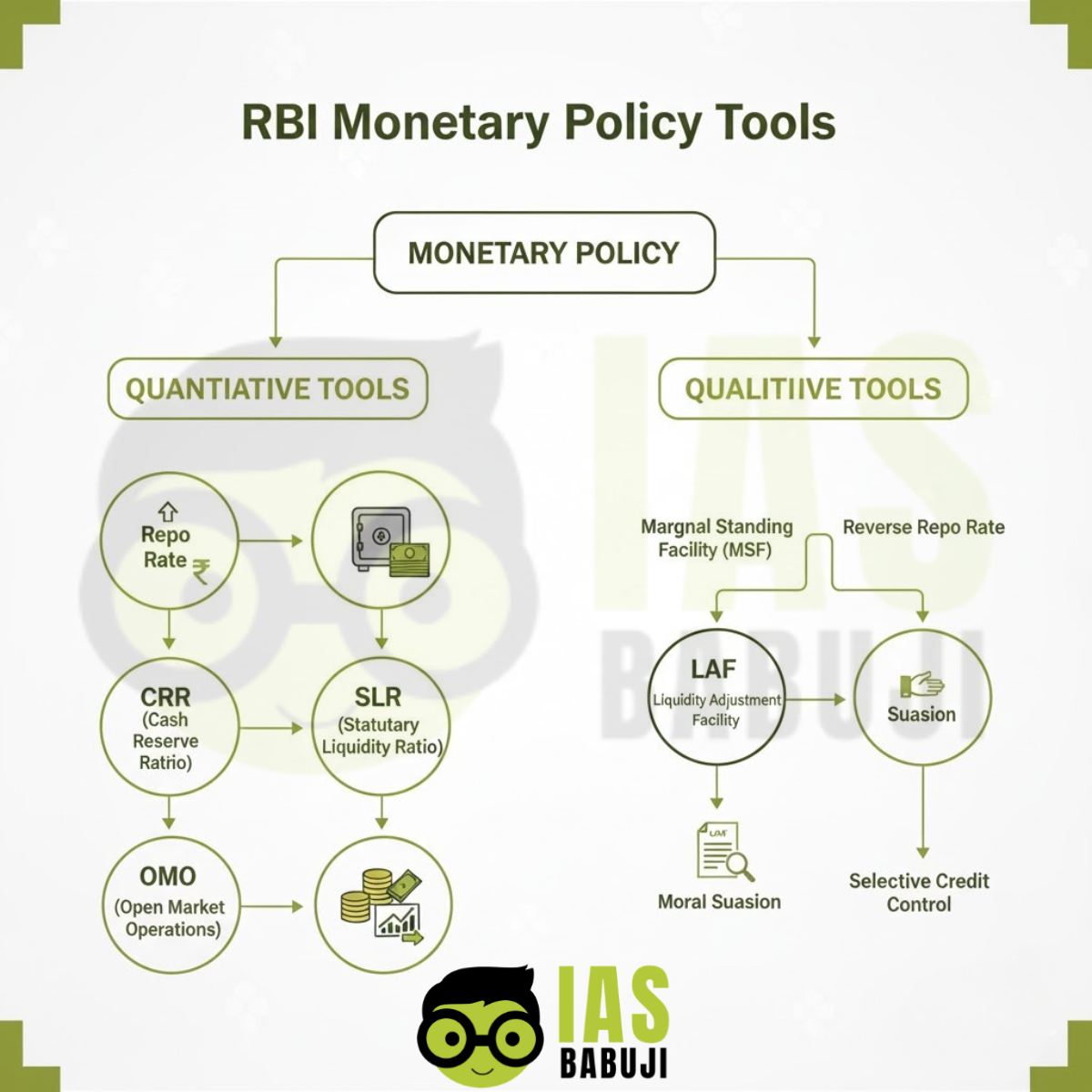

RBI’s Monetary Policy Tools to Control Inflation

Policy Repo Rate

- The rate at which the RBI lends to banks

- A higher repo rate reduces liquidity and demand

Reverse Repo Rate

-

The rate at which the RBI absorbs excess liquidity

Cash Reserve Ratio (CRR)

-

Portion of deposits banks must keep with the RBI

Open Market Operations (OMO)

-

Buying or selling government securities

Liquidity Adjustment Facility (LAF)

-

Manages short-term liquidity conditions

Role of Monetary Policy Committee (MPC)

- Meets every two months

- Balances inflation control with growth needs

- Ensures transparency and accountability

Limitations of Monetary Policy in Controlling Inflation

- Ineffective against supply-side inflation

- Transmission delays in the banking system

- Over-tightening may slow economic growth

Complementary Role of Fiscal Policy

- Rationalising subsidies

- Improving agricultural supply chains

- Enhancing infrastructure investment

- Tax reforms to reduce cost pressures

Inflation control requires coordination between the RBI and the government.

Inflation and Inclusive Growth

- High inflation disproportionately affects the poor

- Food inflation increases poverty vulnerability

- Stable inflation supports inclusive development

Way Forward

- Strengthening supply chains

- Improving agricultural productivity

- Reducing import dependence on energy

- Better inflation forecasting and communication

A multi-pronged approach is essential for sustainable inflation management.

Conclusion

Inflation remains a central challenge for India’s macroeconomic stability and inclusive growth. While moderate inflation can support economic expansion, persistently high inflation erodes purchasing power, widens inequality, and distorts investment decisions. The RBI’s flexible inflation targeting framework has strengthened credibility and transparency in monetary policymaking, but monetary tools alone cannot address supply-side pressures. Effective inflation control requires coordinated action between monetary and fiscal authorities, structural reforms in agriculture and logistics, and resilience against global shocks. For India, maintaining price stability is not merely a macroeconomic goal but a prerequisite for sustainable development and social welfare. A balanced and forward-looking inflation management strategy is therefore essential for achieving long-term economic stability.

FAQs

What is inflation targeting in India?

Inflation targeting is a monetary policy framework where RBI aims to keep CPI inflation at 4 percent within a tolerance band of 2–6 percent.

Which index does RBI use for inflation?

RBI uses the Consumer Price Index (CPI).

Can RBI control food inflation?

RBI has limited control over food inflation as it is largely supply-driven.

Why is inflation bad for the poor?

High inflation increases the cost of essential goods, disproportionately affecting low-income households.