Fiscal Deficit in India: Meaning, Trends, and Long-Term Implications

Introduction

Fiscal deficit is one of the most important indicators of a country’s fiscal health. In India, it plays a decisive role in shaping macroeconomic stability, public debt sustainability, inflationary pressures, and long-term growth prospects. While fiscal deficit allows the government to stimulate the economy during downturns, persistent high deficits can crowd out private investment and burden future generations. For UPSC aspirants, fiscal deficit is a core GS Paper III topic with strong linkages to Budget, FRBM Act, inflation, and monetary-fiscal coordination.

What is Fiscal Deficit?

Fiscal deficit represents the gap between the government’s total expenditure and its total receipts excluding borrowings.

In simple terms, it shows how much the government needs to borrow to meet its expenses.

Formula

Fiscal Deficit = Total Expenditure – (Revenue Receipts + Non-debt Capital Receipts)

Key Deficit Indicators in India

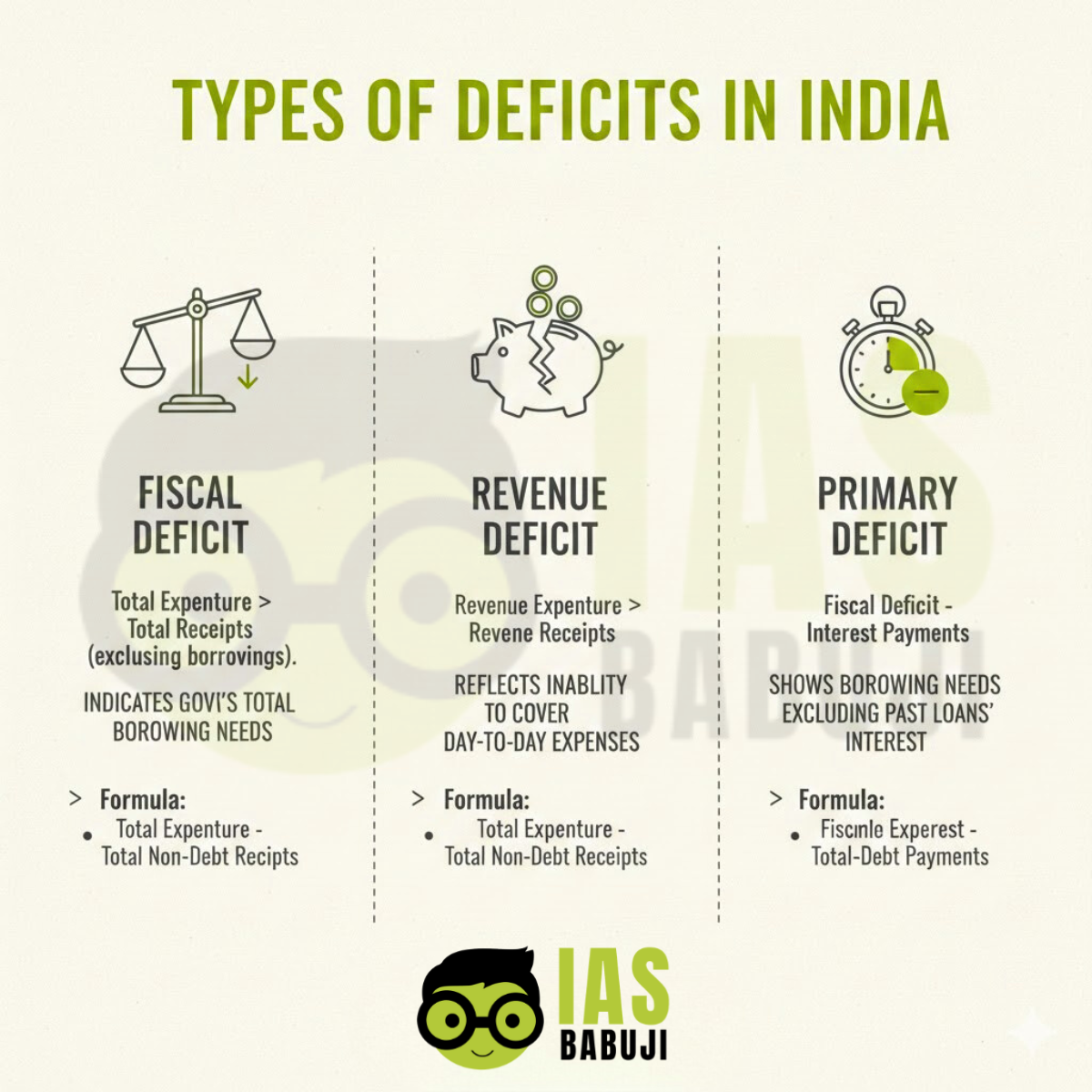

Fiscal Deficit

- Reflects overall borrowing requirement of the government

- Indicates fiscal discipline and macroeconomic stability

Revenue Deficit

- Excess of revenue expenditure over revenue receipts

- Indicates borrowing for consumption rather than asset creation

Primary Deficit

- Fiscal deficit minus interest payments

- Shows current fiscal performance, excluding past debt burden

Measurement and Reporting

- Fiscal deficit is reported annually in the Union Budget

- Expressed as a percentage of Gross Domestic Product (GDP)

- Monitored by Parliament, RBI, and international institutions

Trends in India’s Fiscal Deficit

Pre-Reform Period

-

High deficits due to subsidies, a weak tax base, and low growth

Post-1991 Reforms

- Gradual improvement due to fiscal consolidation

- Introduction of the FRBM framework

Post-Global Financial Crisis

-

Expansionary fiscal policy to boost demand

Pandemic and Post-Pandemic Phase

- Sharp rise due to health spending, welfare schemes, and stimulus

- A gradual consolidation roadmap was announced in recent budgets

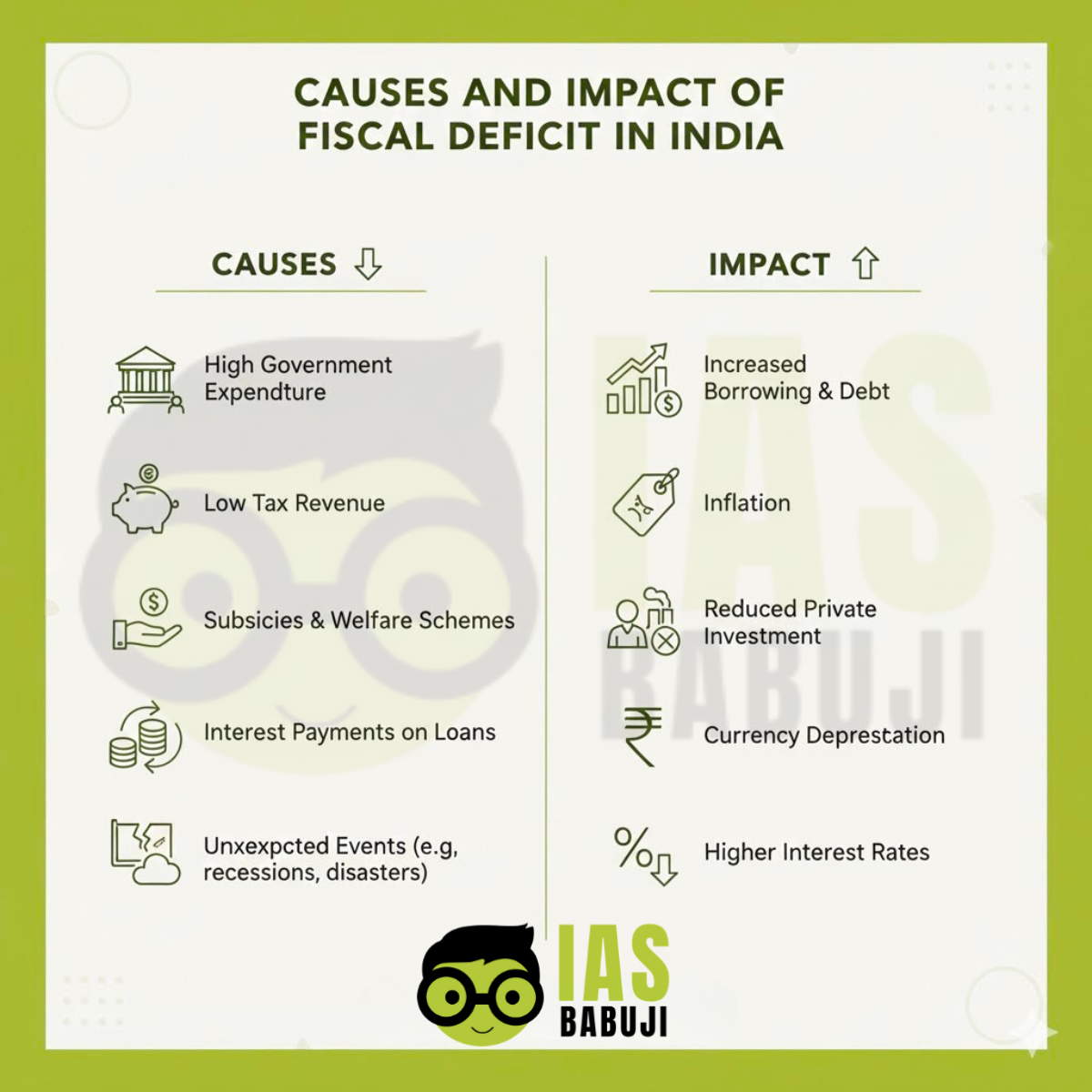

Causes of Fiscal Deficit in India

High Revenue Expenditure

-

Salaries, pensions, subsidies, and interest payments

Subsidy Burden

-

Food, fertilizer, and energy subsidies

Narrow Tax Base

- Large informal sector

- Tax evasion and exemptions

Economic Slowdowns

-

Reduced tax collections during downturns

Populist Measures

-

Free schemes and loan waivers

Impact of Fiscal Deficit on the Indian Economy

Impact on Economic Growth

- A moderate deficit can stimulate growth

- A high deficit may reduce long-term growth

Impact on Inflation

- Excessive borrowing can be inflationary

- Increases demand without matching supply

Impact on Interest Rates

- Higher government borrowing may push up interest rates

- Crowding out of private investment

Impact on Public Debt

- Rising debt servicing costs

- Reduced fiscal space for development

Impact on the External Sector

- May worsen the current account balance

- Affects investor confidence

Fiscal Deficit and FRBM Act

FRBM Act, 2003

- Aimed to institutionalize fiscal discipline

- Targeted reduction of fiscal and revenue deficits

Key Objectives

- Macroeconomic stability

- Intergenerational equity

- Transparency in fiscal operations

FRBM Amendments

- Introduction of escape clauses

- Flexibility during economic shocks

Fiscal Deficit vs Economic Development

Fiscal deficit is not inherently negative. Its quality matters more than its size.

- Borrowing for capital expenditure supports growth

- Borrowing for consumption weakens fiscal sustainability

A growth-oriented deficit focused on infrastructure, education, and health is preferable.

Coordination with Monetary Policy

- High fiscal deficit complicates RBI’s inflation control efforts

- Excessive borrowing affects liquidity and interest rates

- Strong monetary-fiscal coordination is essential

Fiscal Deficit and Inclusive Growth

- Excessive deficits reduce future welfare spending

- Poor fiscal management increases inequality

- Productive public investment supports inclusive development

Way Forward

- Rationalisation of subsidies

- Broadening tax base

- Improving tax compliance

- Prioritising capital expenditure

- Strengthening fiscal transparency

A credible medium-term fiscal consolidation roadmap is essential.

Conclusion

Fiscal deficit is a double-edged sword for a developing economy like India. While it enables the government to support growth, protect vulnerable sections, and respond to economic shocks, persistent high deficits pose serious risks to macroeconomic stability and debt sustainability. The challenge lies in maintaining a careful balance between growth imperatives and fiscal prudence. Strengthening revenue generation, rationalising expenditure, and prioritising productive capital investment are critical to improving the quality of fiscal deficit. A transparent and flexible fiscal framework, supported by strong institutional mechanisms like the FRBM Act, can ensure that fiscal policy remains sustainable and growth-oriented. For India, responsible fiscal management is not just an economic necessity but a foundation for long-term development and intergenerational equity.

FAQs on Fiscal Deficit in India

What is fiscal deficit in simple terms?

Fiscal deficit is the amount the government borrows when its expenditure exceeds its income.

Is fiscal deficit bad for the economy?

A moderate fiscal deficit can support growth, but an excessive deficit can cause inflation and debt problems.

What is the ideal fiscal deficit level?

India aims to gradually reduce fiscal deficit under the FRBM framework.

How is the budgetary deficit different from the revenue deficit?

The revenue deficit reflects borrowing for consumption, while the budgetary deficit shows the total borrowing requirement.