MSME Sector in India: Role in Economic Growth and Key Challenges

Introduction

Micro, Small and Medium Enterprises (MSMEs) form the backbone of the Indian economy. They play a crucial role in employment generation, industrial output, exports, and inclusive growth. Often described as the “engine of growth,” the MSME sector bridges the gap between large industries and the informal economy. In recent years, initiatives such as Make in India, Startup India, and Atmanirbhar Bharat have placed MSMEs at the centre of India’s development strategy. For UPSC aspirants, MSMEs are a high-value topic under GS Paper III with strong static and current affairs relevance.

What are MSMEs?

MSMEs are classified based on investment in plant and machinery/equipment and annual turnover, as revised by the Government of India in 2020.

Classification of MSMEs

- Micro Enterprises – Lowest investment and turnover threshold

- Small Enterprises – Moderate scale of operations

- Medium Enterprises – Higher investment and turnover

This revised definition aims to encourage growth, formalisation, and competitiveness.

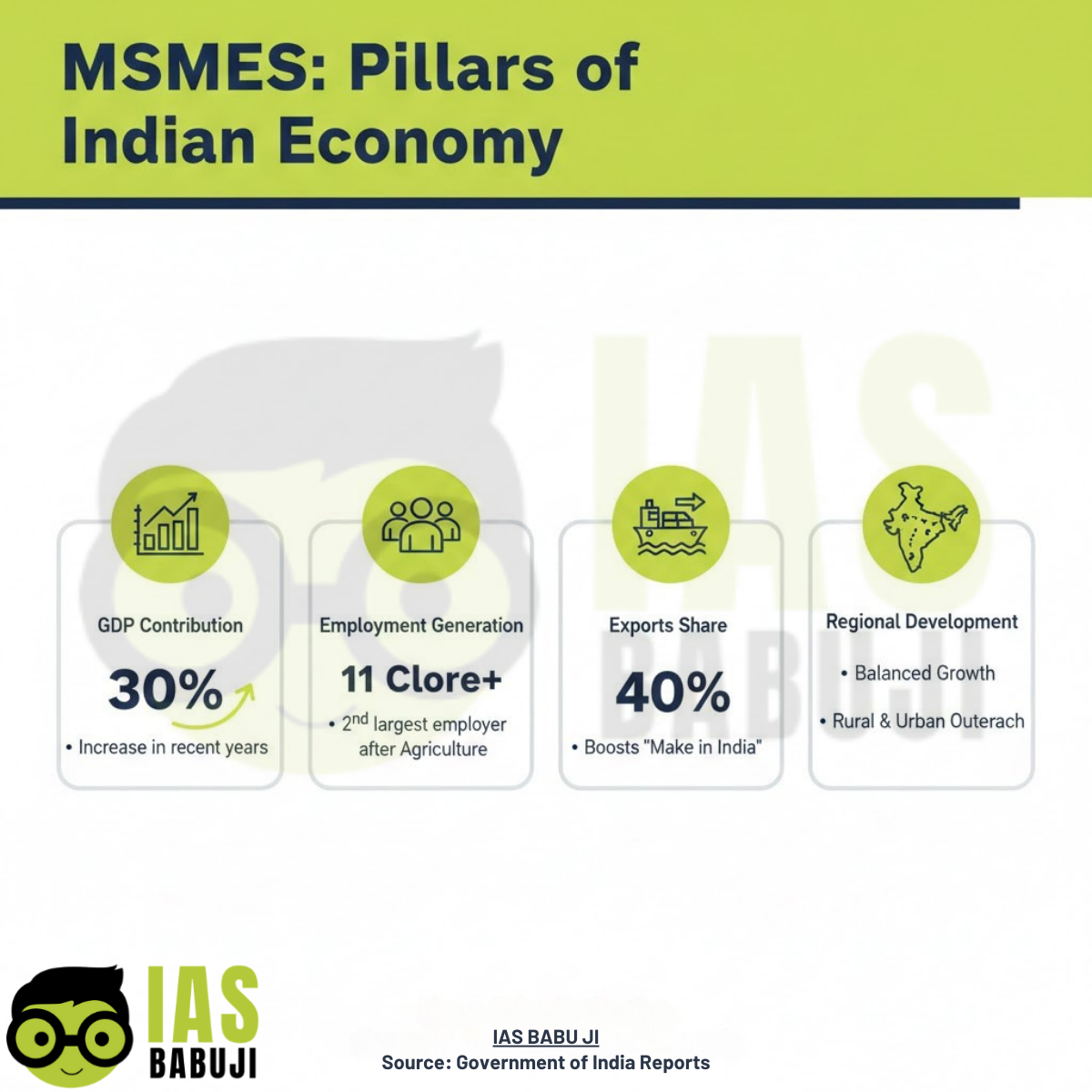

Importance of the MSME Sector in the Indian Economy

Contribution to GDP

- MSMEs contribute significantly to India’s Gross Value Added

- They act as growth multipliers in manufacturing and services

Employment Generation

- Second largest employer after agriculture

- Labour-intensive nature creates jobs at low capital cost

- Absorbs surplus rural labour and supports urban livelihoods

Role in Exports

- Significant share in India’s merchandise exports

- Important in sectors such as textiles, leather, engineering goods, and handicrafts

Regional Balanced Development

- Promotes industrialisation of rural and backward areas

- Reduces regional inequalities

MSMEs and Make in India

MSMEs are central to the success of the Make in India initiative.

Key linkages:

- Act as suppliers and ancillary units to large industries

- Promote indigenous manufacturing and value addition

- Reduce import dependence

- Strengthen domestic supply chains

A strong MSME base is essential for building a self-reliant manufacturing ecosystem.

MSMEs and Employment Generation

- High employment elasticity compared to large industries

- Encourage entrepreneurship and self-employment

- Provide opportunities for women and youth

- Support inclusive growth and poverty reduction

For a labour-abundant country like India, MSMEs are critical for demographic dividend utilisation.

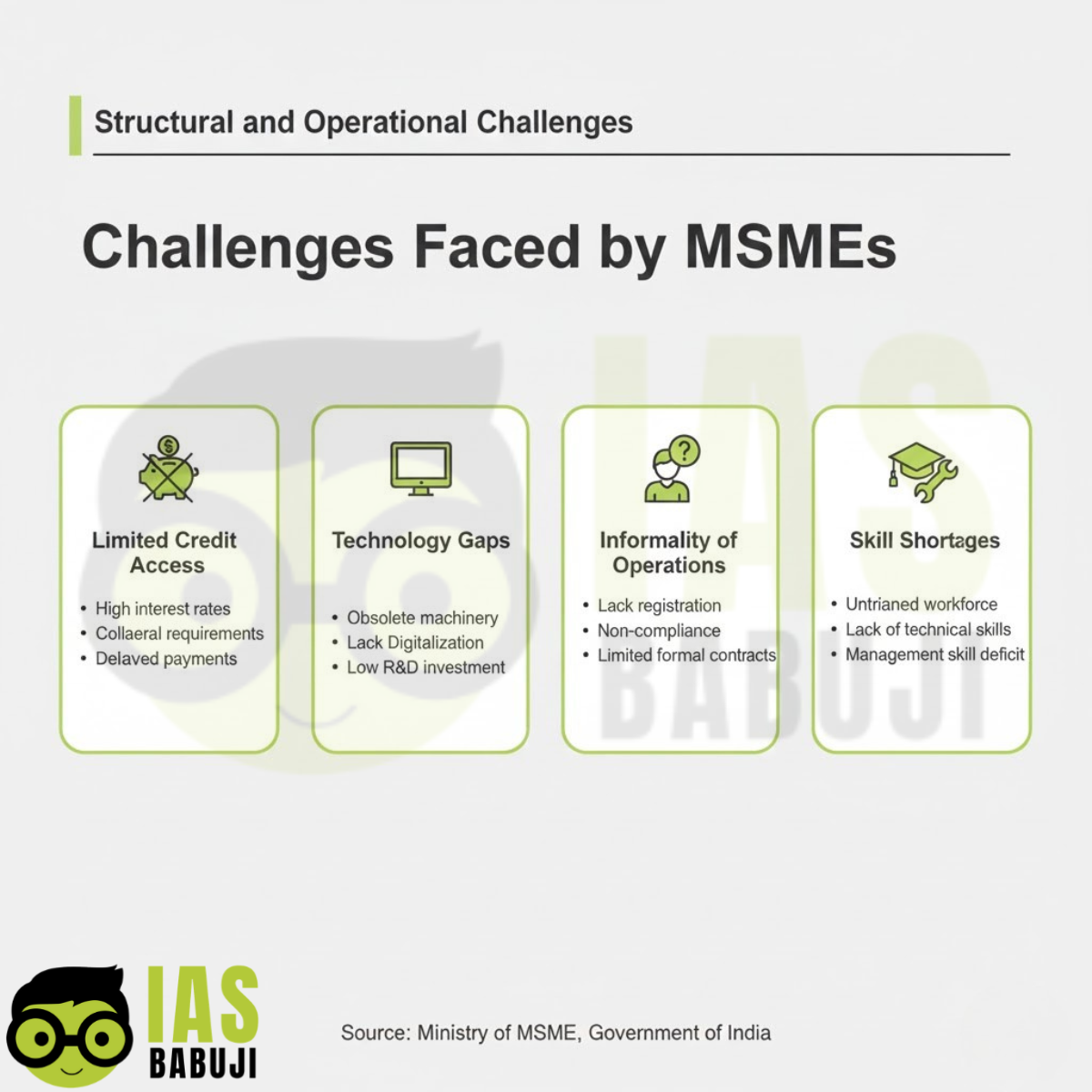

Credit and Finance Challenges Faced by MSMEs

Limited Access to Formal Credit

- Dependence on informal sources

- Lack of collateral and credit history

High Cost of Borrowing

- Higher interest rates compared to large firms

Delayed Payments

- Cash flow stress due to delayed payments by buyers

Government initiatives like MUDRA, CGTMSE, and the Emergency Credit Line Guarantee Scheme aim to address these issues.

Structural and Operational Challenges

Informality

- A large number of unregistered enterprises

- Low compliance and productivity

Technology Gaps

- Limited adoption of modern technology

- Low investment in research and innovation

Skill Constraints

- Shortage of skilled manpower

- Limited access to training

Market Access

- Difficulty in accessing global markets

- Low branding and marketing capabilities

Impact of GST and Digitalisation

GST and digital platforms have transformed the MSME ecosystem.

Positive impacts:

- Improved formalisation

- Easier market integration

- Transparency in taxation

Challenges:

- Compliance burden for small enterprises

- Initial adjustment costs

Digital initiatives like Udyam Registration and the GeM portal have improved the ease of doing business.

Government Initiatives for MSME Development

Atmanirbhar Bharat Package

- Credit support and liquidity measures

- Revised MSME definition

PMEGP and PM Vishwakarma

-

Promotes entrepreneurship and traditional artisans

Production Linked Incentive (PLI)

-

Encourages MSME participation in global value chains

Skill Development Programs

-

Focus on upskilling and reskilling the workforce

MSMEs and Inclusive Growth

MSMEs contribute to inclusive and sustainable growth by:

- Supporting the rural economy

- Encouraging women-led enterprises

- Reducing income inequalities

- Promoting local innovation

They align closely with India’s goals of social justice and economic equity.

Way Forward

- Improving access to affordable credit

- Strengthening technology adoption

- Reducing compliance burden

- Enhancing export competitiveness

- Creating robust MSME clusters

A holistic policy approach is essential to unlock the full potential of the MSME sector.

Conclusion

The MSME sector is a vital pillar of India’s economic architecture, contributing significantly to growth, employment, exports, and regional development. While the sector has demonstrated resilience and adaptability, it continues to face structural, financial, and technological challenges. Addressing these constraints through targeted policy support, improved access to credit, skill development, and digital integration is critical. In the context of Make in India and Atmanirbhar Bharat, a strong and competitive MSME ecosystem is indispensable for achieving sustainable and inclusive economic growth. For India, empowering MSMEs is not merely an economic strategy but a long-term development imperative that can transform livelihoods and strengthen the national economy.

FAQs on the MSME Sector in India

Why are MSMEs important for India?

MSMEs generate employment, support exports, promote regional development, and contribute significantly to GDP.

What are the major challenges faced by MSMEs?

Limited access to credit, technology gaps, informality, skill shortages, and delayed payments.

How does Make in India support MSMEs?

It integrates MSMEs into manufacturing supply chains and promotes domestic production.

Which UPSC paper covers MSMEs?

GS Paper III (Indian Economy).