Carbon Credit Trading Scheme (CCTS): Meaning, Working, India’s Plan & UPSC Notes (GS 3)

Climate change is no longer only an environmental issue—it is now a global economic, strategic, and development challenge. Countries are under pressure to reduce greenhouse gas emissions while continuing economic growth.

To achieve this balance, market-based mechanisms like Carbon Credit Trading have emerged as an important tool. India has also moved in this direction through the Carbon Credit Trading Scheme (CCTS), which aims to create a structured carbon market in the country.

For UPSC aspirants, this topic is important because it connects:

- Environment and climate commitments

- Economic policy and market instruments

- India’s climate targets (NDCs)

- International climate frameworks

1. What is Carbon Credit Trading?

Carbon Credit (Meaning)

A carbon credit is a tradable certificate that represents the reduction or removal of greenhouse gases (GHGs).

In most carbon markets:

1 carbon credit = 1 tonne of CO₂ equivalent (tCO₂e) reduced or removed.

This means if a company reduces its emissions by 1 tonne compared to a baseline, it can generate one carbon credit and sell it.

2. What is Carbon Credit Trading?

Carbon credit trading is a system where:

- Entities that emit less than allowed can sell credits

- Entities that emit more than allowed must buy credits

This creates a market-based incentive for reducing emissions.

3. What is the Carbon Credit Trading Scheme (CCTS)?

The Carbon Credit Trading Scheme (CCTS) is India’s policy framework to establish a national carbon market.

The scheme is designed to:

- Encourage emission reduction

- Create a structured market for carbon credits

- Support India’s climate goals

- Promote low-carbon technologies

4. Why did India launch CCTS? (Need and Background)

India has committed internationally to:

Key Climate Commitments

- Reduce the emissions intensity of GDP

- Achieve Net Zero by 2070

- Increase share of non-fossil energy capacity

- Create an additional carbon sink through forests

However, India faces a challenge:

- Industrial growth is necessary

- Energy demand is rising

- Coal remains significant in the energy mix

So, India needs tools that:

- Reduce emissions without harming growth

- Encourage industries to invest in clean tech

CCTS aims to do this.

5. CCTS and India’s Legal/Policy Basis

India’s carbon market is backed by reforms in energy and environment policy.

Key Supporting Policy

India’s carbon market is linked to:

- Energy Conservation Framework

- National-level energy efficiency measures

- Industrial decarbonisation strategy

CCTS also connects to India’s earlier experience with:

- Perform, Achieve and Trade (PAT) scheme

- Renewable energy certificates (REC)

6. How Does CCTS Work? (Step-by-Step)

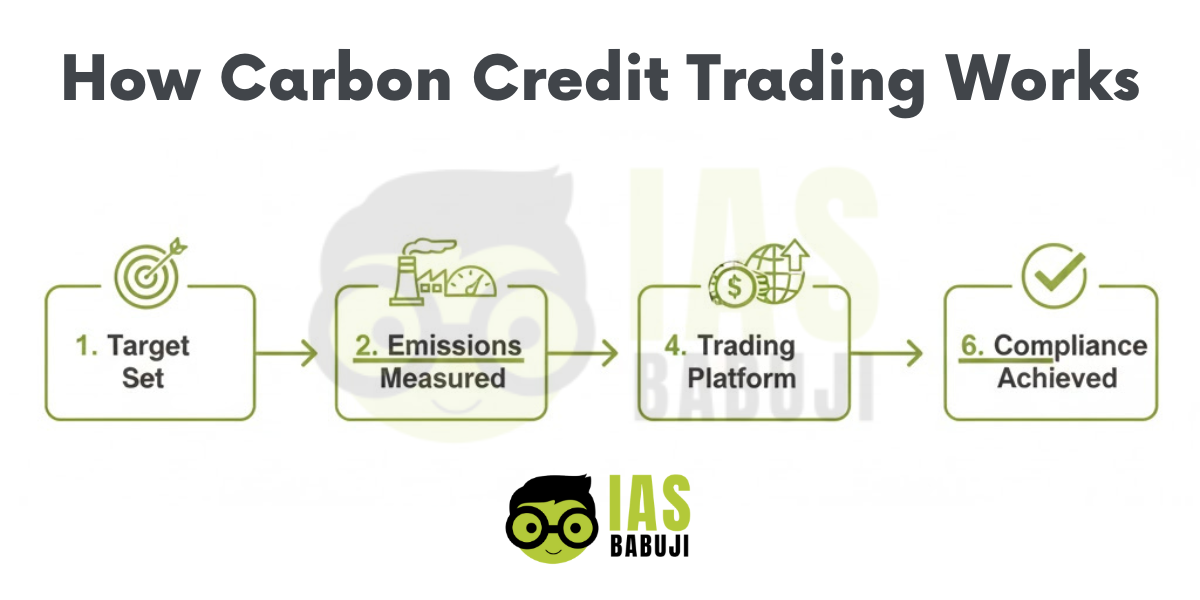

The Carbon Credit Trading Scheme typically works through:

Step 1: Identifying Covered Sectors

The government identifies sectors such as:

- Power

- Steel

- Cement

- Refineries

- Fertilizers

- Heavy industries

These are usually high-emission sectors.

Step 2: Setting Emission Targets or Standards

The government sets:

- Emission intensity targets OR

- Carbon reduction targets

Each entity gets a benchmark.

Step 3: Measuring and Reporting Emissions

Companies must report emissions using:

- Standard methodologies

- Verified measurement systems

This is crucial for transparency.

Step 4: Issuing Carbon Credits

If a company performs better than its target:

✅ It receives carbon credits.

Step 5: Trading Carbon Credits

Entities can trade credits through:

- Exchanges

- Market platforms

- Regulated trading mechanism

Step 6: Compliance and Penalty

If an entity fails to meet targets:

- It must buy credits

- Or face penalties

This creates compliance pressure.

7. Types of Carbon Markets Under CCTS

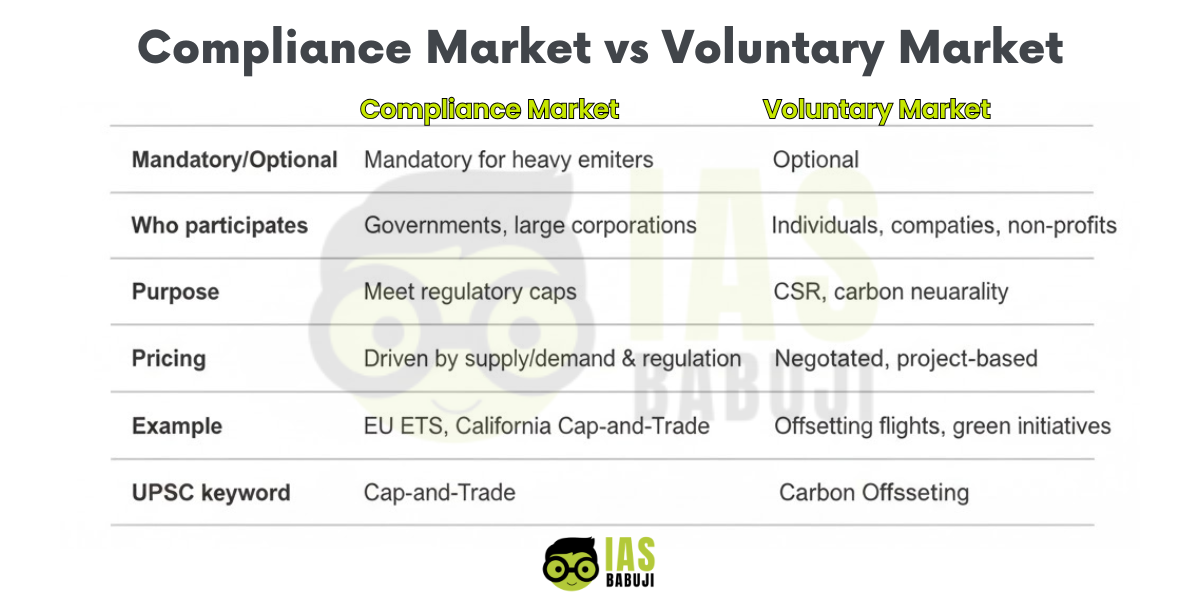

Carbon markets usually have two broad types:

A) Compliance Carbon Market

This is a regulated market.

- Participation is mandatory for covered entities

- The government sets caps or targets

- Trading is used to meet compliance

This is like:

-

EU Emissions Trading System (EU ETS)

B) Voluntary Carbon Market

This is not mandatory.

- Entities voluntarily reduce emissions

- Generate credits

- Sell to buyers wanting carbon neutrality

Example:

-

Companies are buying credits for ESG goals

India’s CCTS

India’s plan is expected to develop a structured market that can include:

- Compliance mechanism

- Voluntary mechanism

8. Key Institutions Involved in CCTS (UPSC Relevant)

India’s carbon market will require multiple institutions, such as:

Government Bodies

- Central government (policy-making)

- Regulatory authorities

- Climate/energy agencies

Technical Institutions

- Emission verification bodies

- Auditors and validators

- Data monitoring agencies

Market Infrastructure

- Trading exchanges

- Registry for carbon credits

- Settlement and tracking systems

9. Benefits of Carbon Credit Trading Scheme (CCTS)

1) Cost-Effective Emission Reduction

Instead of forcing all industries to reduce equally, carbon trading ensures:

-

Reductions happen where it is cheapest

2) Encourages Clean Technology

Industries will invest in:

- Energy efficiency

- Renewable energy

- Cleaner fuel switching

- Carbon capture (in future)

3) Supports India’s Climate Goals

Helps India meet:

- NDC targets

- Net zero pathway

- Emission intensity reduction goals

4) Creates Green Finance and New Markets

Carbon credits become a new financial asset, helping:

- Green investment

- Climate finance

- New business opportunities

5) Improves Global Competitiveness

With global rules like:

- Carbon border taxes

- ESG compliance

Indian industries must reduce carbon intensity to remain competitive.

10. Challenges and Concerns in CCTS (UPSC Mains Value)

1) Measurement and Verification Issues

Carbon trading depends heavily on:

- Accurate emission measurement

- Strong verification

- Transparent reporting

If the measurement is weak, the system can lose credibility.

2) Risk of Greenwashing

Some companies may:

- Buy credits instead of reducing emissions

- Use credits for branding without real action

3) Market Manipulation and Price Volatility

Carbon markets may face:

- Artificial scarcity

- Speculation

- Unstable credit prices

4) Lack of Awareness and Capacity

Many industries, especially MSMEs, may struggle with:

- Reporting systems

- Compliance costs

- Technical knowledge

5) Equity and Development Concerns

India is still a developing country.

A strict carbon market may:

- Increase costs for industries

- Impact job creation

- Raise consumer prices

Hence, India must balance:

climate action + development needs

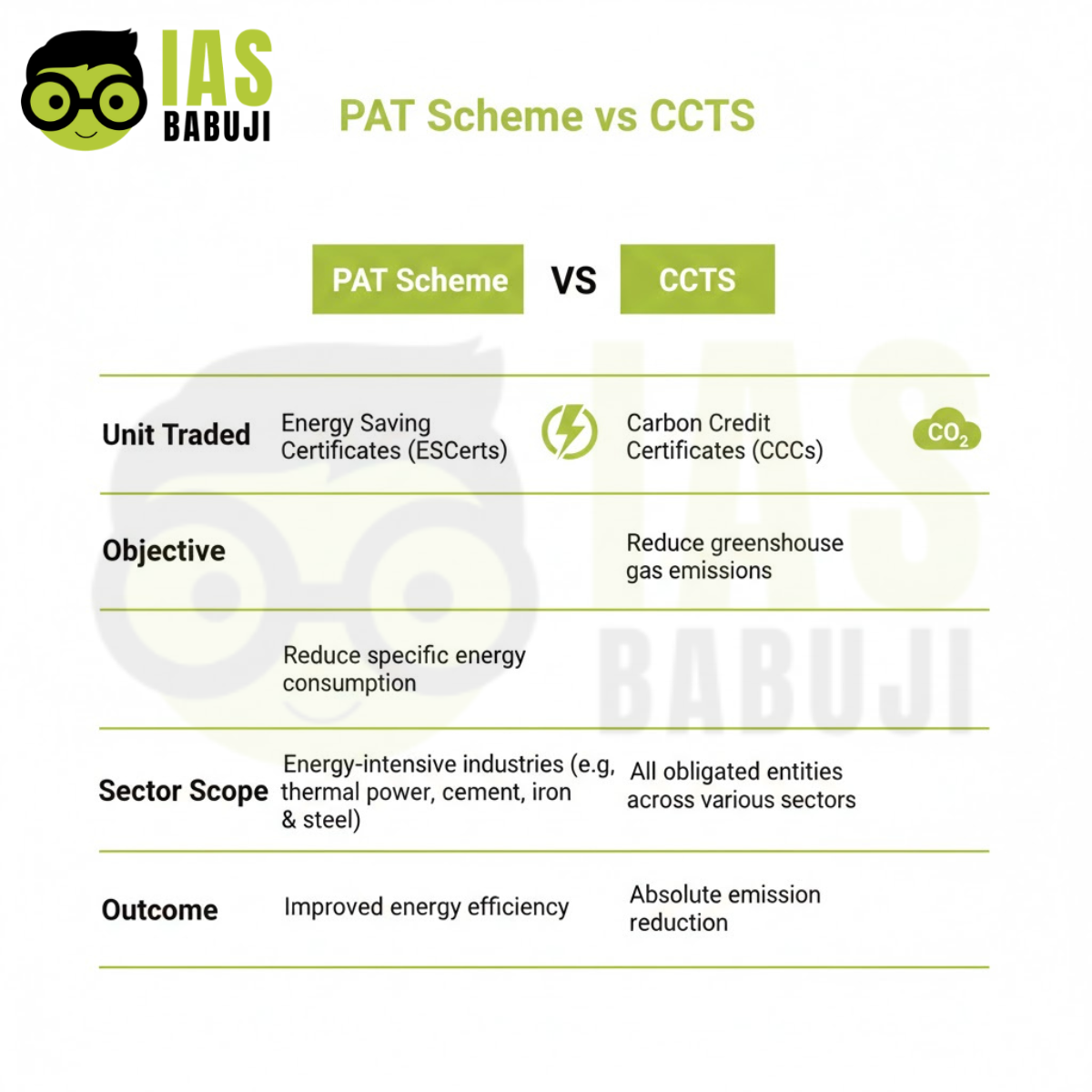

11. Difference Between PAT Scheme and CCTS (Very Important)

UPSC may ask about conceptual differences.

| Feature | PAT Scheme | CCTS |

|---|---|---|

| Focus | Energy efficiency | Emission reduction (carbon) |

| Unit traded | Energy saving certificates | Carbon credits |

| Sector | Energy-intensive industries | Wider scope possible |

| Nature | Efficiency-based | Carbon-based market |

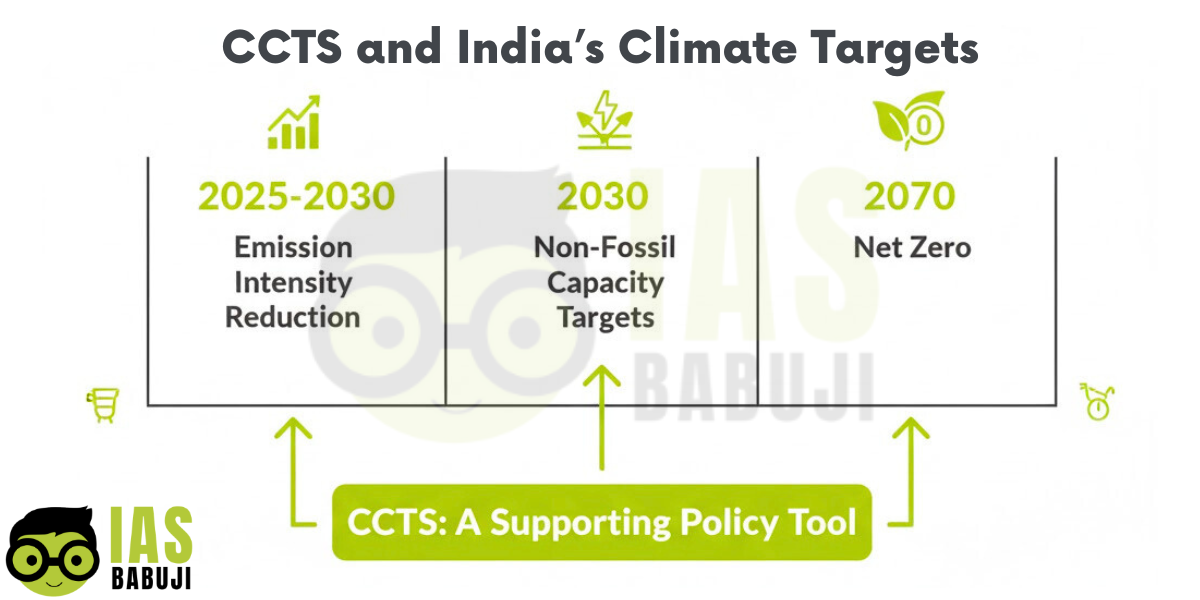

12. Carbon Credit Trading and India’s Net Zero Target (2070)

CCTS is expected to play a role in India’s long-term targets by:

- Helping industries decarbonise gradually

- Creating incentives for low-carbon investments

- Building India’s climate market ecosystem

However, it cannot replace:

- Renewable expansion

- Grid reforms

- Electric mobility

- Cleaner industrial processes

It is a supporting tool, not the only solution.

13. International Context: Why Carbon Markets Matter Now

Carbon markets are becoming more important due to:

1) Paris Agreement (Article 6)

Article 6 encourages:

- International cooperation

- Carbon trading between countries

- Market mechanisms for emissions reduction

2) Carbon Border Adjustment Mechanisms (CBAM)

Some regions impose carbon-linked trade measures.

This means Indian exporters (steel, cement, aluminium, etc.) will need:

- Lower emissions

- Carbon reporting

- Cleaner supply chains

A domestic carbon market helps Indian industries prepare.

14. UPSC Prelims Pointers (Quick Revision)

- Carbon credit = 1 tonne CO₂ equivalent

- CCTS aims to create India’s carbon market

- Trading gives incentives for emission reduction

- Helps in achieving NDC + Net Zero 2070

- Requires MRV: Monitoring, Reporting, Verification

- Risk areas: greenwashing, weak verification, price volatility

Conclusion

The Carbon Credit Trading Scheme (CCTS) is a major step toward building a structured carbon market in India. It represents a shift from a purely regulatory climate policy to a market-based climate governance model.

If implemented effectively with strong monitoring and verification, CCTS can:

- Drive industrial decarbonisation

- Encourage innovation

- Support India’s climate commitments

- Improve export competitiveness in a carbon-conscious world

For UPSC, the topic is crucial because it lies at the intersection of Environment, Economy, Governance, and International commitments.

FAQs

Q1. What is a carbon credit?

A carbon credit is a tradable certificate representing the reduction/removal of 1 tonne of CO₂ equivalent.

Q2. What is the Carbon Credit Trading Scheme (CCTS)?

CCTS is India’s framework to establish a national carbon market where carbon credits can be generated and traded.

Q3. What is the difference between carbon trading and carbon tax?

Carbon trading uses a market mechanism to buy/sell credits, while a carbon tax directly charges a fixed tax per unit of emission.

Q4. Is CCTS a compliance market or a voluntary market?

It is designed mainly as a structured market and can include compliance elements for specific sectors, while also supporting voluntary trading.

Q5. Why is CCTS important for India’s exports?

Many global markets are linking trade to carbon emissions. A domestic carbon market improves India’s readiness for carbon reporting and lower-carbon production.

Q6. What are the major challenges in CCTS?

Key challenges include weak emission measurement, risk of greenwashing, lack of capacity in industries, and price volatility.