Why Inflation Hurts the Poor More Than the Rich: An Economic and Ethical Analysis

Introduction

Inflation is often discussed in terms of rising prices, but its real impact goes much deeper than numbers and indices. While inflation affects all sections of society, its burden is unevenly distributed. For economically weaker sections, even a small rise in prices can threaten basic survival, whereas the affluent can absorb price shocks more easily. In a developing economy like India, where a large population depends on fixed or low incomes, inflation becomes not just an economic issue but a social and ethical concern. Understanding why inflation hurts the poor disproportionately is crucial for evaluating economic policy, governance priorities, and the idea of inclusive growth.

Understanding Inflation in Simple Terms

Inflation refers to a sustained rise in the general price level of goods and services over time, leading to a fall in purchasing power.

Common forms of inflation in India include:

- Food inflation

- Fuel and energy inflation

- Core inflation (excluding food and fuel)

While headline inflation appears uniform, its real-life impact varies sharply across income groups.

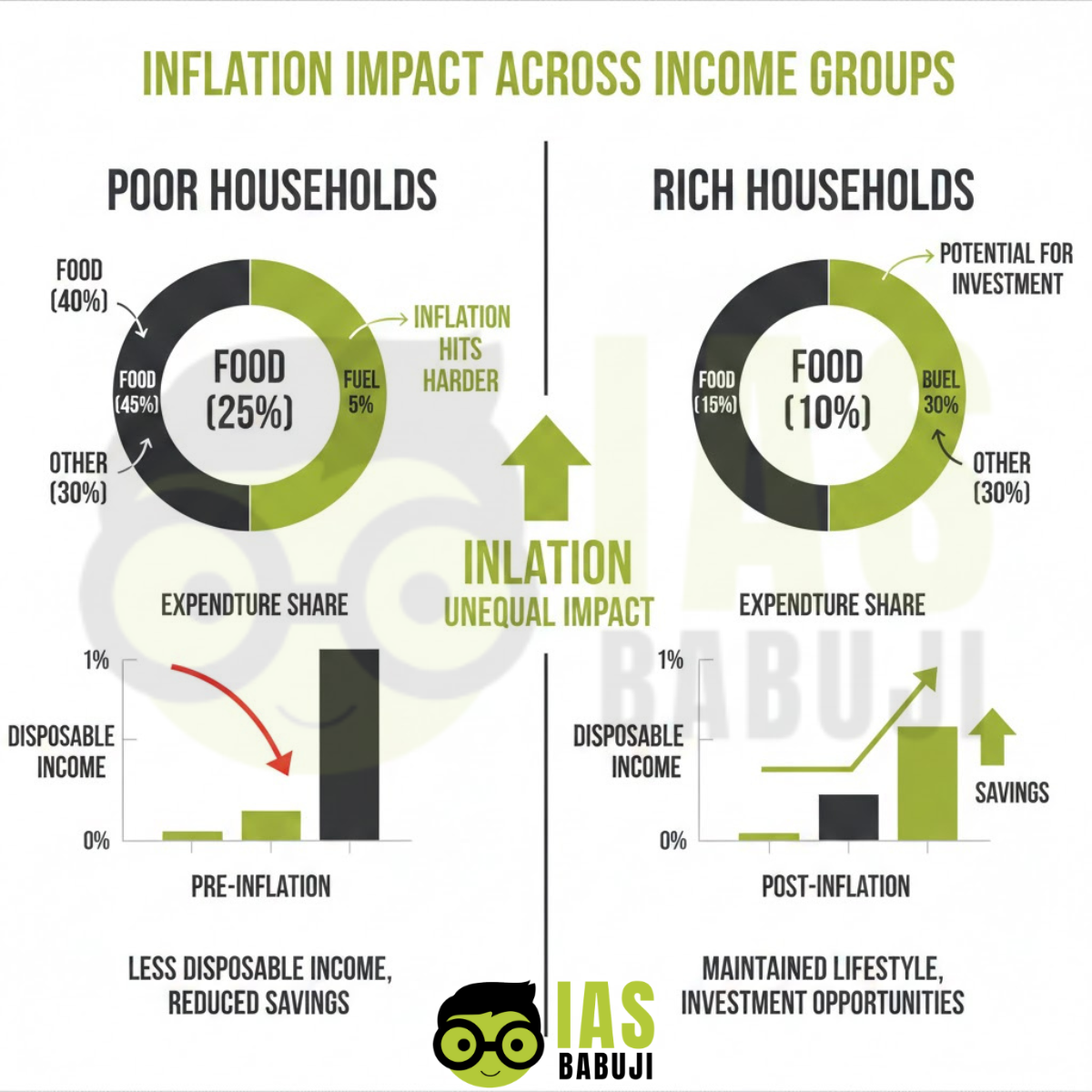

Consumption Patterns: Poor vs Rich

The poor and the rich spend their incomes very differently.

Key differences:

- Poor households spend a larger share of income on essentials such as food, fuel, rent, and transport

- Rich households spend more on discretionary items and services

- Essentials have limited substitutes and inelastic demand

As a result, price rises in food and fuel hit the poor immediately and severely.

Why Inflation Hurts the Poor More

Higher Share of Income Spent on Essentials

Food and fuel account for a major portion of poor households’ expenditure. Even moderate inflation in these items sharply reduces real income and consumption.

Lack of Inflation Protection

The rich often have assets such as real estate, equities, or gold that hedge against inflation. The poor largely depend on cash incomes with no such protection.

Wage Rigidity and Informal Employment

- Wages of informal workers do not adjust quickly to inflation

- Daily wage earners face income uncertainty

- Real wages often decline during inflationary periods

Limited Access to Credit

The poor have restricted access to formal credit and savings, forcing them to reduce consumption or borrow at high interest rates.

Inflation as a Regressive Phenomenon

Inflation is considered regressive because it affects lower-income groups more intensely than higher-income groups.

Reasons:

- Fixed incomes lose real value

- Absence of bargaining power

- Higher vulnerability to price shocks

This regressive nature widens income and consumption inequality.

Food Inflation: The Biggest Burden

In India, food inflation is the most damaging for the poor.

Key impacts:

- Reduced nutritional intake

- Shift to cheaper and lower-quality food

- Long-term health consequences

Food inflation thus directly affects human capital formation, especially among children.

Ethical Dimension of Inflation

From an ethics perspective, inflation raises serious moral questions.

Ethical concerns include:

- Violation of the right to a dignified life

- Inter-generational injustice due to malnutrition

- Unequal burden-sharing in society

The State has an ethical responsibility to protect vulnerable groups from the adverse effects of inflation.

Role of Government in Protecting the Poor

Governments play a critical role in cushioning inflation’s impact.

Key interventions:

- Public Distribution System (PDS)

- Food and fertilizer subsidies

- Direct Benefit Transfers (DBT)

- Employment guarantee schemes

Such measures help stabilize consumption and prevent extreme hardship.

Role of RBI and Monetary Policy

The Reserve Bank of India focuses on price stability through inflation targeting.

However:

- Tight monetary policy may slow growth

- The poor are affected both by inflation and the slowdown

Balancing inflation control with growth and employment is a key governance challenge.

Inflation, Inequality, and Social Stability

Persistent inflation can lead to:

- Rising inequality

- Social dissatisfaction

- Loss of trust in institutions

Economic instability often translates into social and political instability.

Way Forward

Policy priorities should include:

- Strong supply-side measures to control food inflation

- Better storage, logistics, and agricultural reforms

- Targeted welfare rather than blanket subsidies

- Strengthening social security for informal workers

- Maintaining balance between growth and price stability

Inflation management must be people-centric, not just index-centric.

Conclusion

Inflation is far more than a macroeconomic indicator; it is a lived reality that affects people differently based on income, occupation, and vulnerability. For the poor, rising prices erode purchasing power, compromise nutrition, and undermine dignity, while the rich possess greater capacity to absorb or hedge against inflationary pressures. This unequal impact makes inflation a deeply ethical issue, alongside being an economic one. In a country like India, controlling inflation is essential not only for macroeconomic stability but also for social justice and inclusive growth. Effective inflation management requires a balanced approach that combines sound monetary policy with strong welfare mechanisms and supply-side reforms. Only then can economic stability translate into improved living standards for all sections of society.

FAQs on Why Inflation Hurts the Poor More Than the Rich

Why is inflation considered regressive?

Because it affects low-income groups more severely than high-income groups.

Which type of inflation hurts the poor the most?

Food inflation has the most damaging impact on poor households.

How does inflation affect real wages?

If wages do not rise at the same pace as prices, real wages decline.

Which UPSC papers cover this topic?

GS Paper III and Essay.

SEO Meta Data

Meta Title:

Why Inflation Hurts the Poor More Than the Rich | Indian Economy GS III

Meta Description:

Detailed GS III analysis on why inflation impacts the poor more than the rich, covering economics, ethics, and governance dimensions.

Tags (comma-separated)

Feature Image Prompt (Light Background, 3D Illustrator – Theme #b3c839)

Prompt:

“3D illustrator-style conceptual artwork with very light near-white background, showing contrast between a low-income family struggling with rising food prices and a wealthy household unaffected, inflation symbols and price tags subtly integrated, clean academic composition, soft lighting, minimal shadows, ample negative space for text, UPSC economy theme, accent color #b3c839, professional editorial style”

Infographic Prompts with Placement

Infographic 1: Inflation Impact Across Income Groups

Prompt:

“Comparison infographic showing how inflation affects poor and rich households differently, expenditure shares on food, fuel, and savings, clean exam-oriented design, color theme #b3c839”

Placement: After section “Consumption Patterns: Poor vs Rich”

Infographic 2: Food Inflation and Poverty Linkage

Prompt:

“Infographic explaining linkage between food inflation, nutrition, and poverty outcomes in India, minimal design, UPSC GS III style, color #b3c839”

Placement: After section “Food Inflation: The Biggest Burden”